It's just so easy to get distracted or overloaded with all the noise and BS going on lately that I felt compelled to send you a friendly reminder of the core basics of of how to win at trading and avoid losing money

It's just so easy to get distracted or overloaded with all the noise and BS going on lately that I felt compelled to send you a friendly reminder of the core basics of of how to win at trading and avoid losing money

…and yes, in less than 5 minutes

It's just so easy to get distracted or overloaded with all the crap and misinformation

To win at trading, in a very realistic and sensible manner and in the real world (not like you see on so many webinars where they show the whole trade played out and make it look SO simple, but where it rarely if ever works out like they present it)

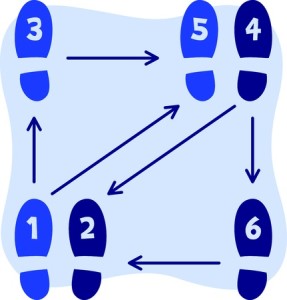

Here are the 5 Steps to win at trading and avoid losing money (for real)

- Get clear on your objectives

This starts with your personal objectives which dictate your objectives for your trading, and involves more than just dollars

- Get clear on your system – BEFORE you risk real money on it

So many traders struggle with consistent results, while trying to work with a “system” that often isn't really even a system.

They're working with an idea for a system, or a huge mish-mash of pieces of systems that tries to catch any and every possible opportunity on any given day

What they've got is usually poorly defined and/or poorly documented if it is documented at all

Being a Certified Quality Engineer where systemization and consistency are the core of the job, I've taught hundreds of traders over the last 12+ years how to get consistent results from their trading – and it all starts with getting your system right

It all starts with having a repeatable and properly defined system.

If you don't get this part right, pretty much all your other efforts are of limited value at best

- Prove out your system so that you know that it works, how well it works, and that it can be realistically expected to produce and actually meet your financial goals – BEFORE you risk real money on it

Once you have your system properly documented, then it's time to make sure that it will deliver as you'd like it to, but do so in a manner where you can take yourself out of the equation as a variable

This means backtesting and /or forward testing in your demo account

By testing your system in an ideal environment (no time or money pressure), you can find out the truths about the system itself, what it is capable of and what its limitations are

It is only when you have proven out the system itself that you can begin to have true confidence in it

- Practice your system to establish proficiency and confidence in it and yourself

Trading is a SKILL-based occupation and a grave mistake too many traders make is trading live money before they've established solid proficiency with their system

If you read the stories of the trading legends, they ALL focused on their skills using a method that they KNEW worked

If you're trading without the experiential knowledge, that confidence from success with your own hands (NOT the claims or “success” of others), then you will never fully be free of the doubt that creates so many problems and causes bad decisions

- Run your metrics and track them over time

All successful business operations, regardless of their nature, require knowing the key numbers to pay attention to and to track

The numbers provide the objective perspective that indeed things are working as intended and give you the peace of mind you seek

If you don't have the numbers or they don't work, then you don't have a reliable operation and nothing in which to feel secure

ONLY when you've proven out your system, when you have the metrics that provide measured PROOF that your system and you trading it will deliver…

ONLY then is it wise to trade with real money

By following these five steps, you give yourself the maximum advantage and the greatest likelihood of success

…at the same time, you also minimize the chances of losing money

And as one of my readers said,

It is also truly only after going through these five steps that you can put together a reasonable business plan because this is really the only way to have realistic numbers on which to base your plan

If this makes sense to you and you feel that you've gotten off-track and this has been helpful, then excellent! That has been my intent.

If you haven't yet gotten consistently profitable or you're struggling with the confidence that you'd like to have, then I completely understand

And while these steps may seem obvious, you'd probably be amazed at how many traders skip part or all of them, then wonder why things aren't working out

Plus of course, there are more details to making the above tasks happen, and that's why I help traders work through them – this is where my years as a Quality Engineer have proven so useful (consistency, testing, measurement, proving out processes, etc.)

If you'd like my help with these steps, this process, then I invite you to sign up for the Trading System Mastery Home-Study Course

OR if you'd like for ME to personally coach you through the process, via live, weekly, one-to-one calls, then click here

Whether you choose to get my help or not, if you are indeed serious about making your trading a success, these are the five simple steps to follow to put odds in your favor, the how to win at trading and avoid losing money, so put them to use!

Have a great weekend!

Cheers

Brian

![Read more about the article [Day Trading Psychology] “What I Need To Fix Is ME!”](https://insideouttrading.com/wp-content/uploads/2022/12/fix-me-300x158.png)