Seriously.

So many traders are led to believe that discipline is the key, the solution to their problems

If they could just be more disciplined and stick to their system, then everything would be fine

But how often does that work out?

… and for how long?

You see, the problem is NOT a lack of discipline

… or even emotional control

This really shouldn't even be a topic of conversation if you think about it

I mean, how often and where else in your life are you having these kinds of issues?

Do you have trouble staying in the lane when driving your car? NO

Have you ever had major “discipline” issues in any job you've ever had?

Not likely

You'd just go to work and do your thing, right?

Some days were better than others, but you weren't struggling to control your emotions and just do what you were supposed to do

Trading really should be no different

And it's NOT a struggle when you're doing it right

You get up.

You trade.

You enjoy it, and some days are better than others, but it's not this huge emotional roller coaster

If you're fighting with your emotions, that's a sign that there's something wrong

And trying to use discipline to overcome or control your emotions is not solving the issue

It's not filling the gap

And NO, we're NOT talking about something your Mommy said to you when you were 5 years old that hurt your feelings and ruined you as far as trading

If that were the case, you'd be ruined period and you wouldn't be in a position to trade in the first place

But you ARE in a position to trade, which means that you've demonstrated that you have what it takes

There must be something else, right?

There is

When I discovered it, I was able to get my trading turned around in a hurry

…and my confidence and my consistency of execution both skyrocketed

Cool thing is, the true solution is something you can utilize too for similar results in your trading

…because it address the real root cause of the issues

I'll share it with you tomorrow, so be sure to check your email inbox

Cheers

Brian McAboy

“The Consistency Coach”

Host of the “Consistent Profits Podcast“

“Focus on consistency first, because when you have consistency, profit is easy”

P.S. Whenever you're ready, here are 4 ways I can help you make more money and more consistently with your trading

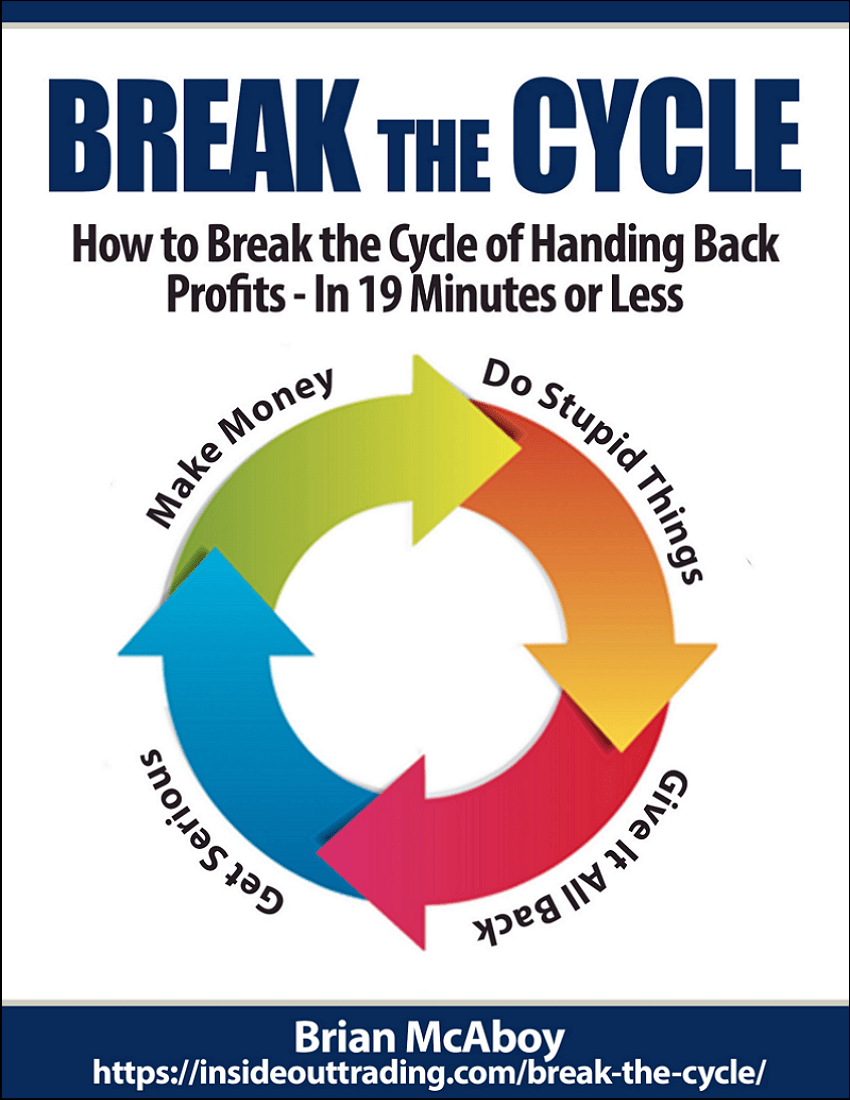

1. Are you ready to break the cycle of ‘make money, give it back'?

Discover the things you can do in the next 19 minutes to break the cycle.

That's right, just 19 minutes, including the time it takes to read the very short guide

click here to download the pdf

2. Check out the “The Science of Consistency Applied to Trading”

This is the recording of a masterclass I did a while back that shows you how to take advantage of the success secret being used in other industries – and how you can use it in your trading to maximize profits and peace of mind – click here

3. Get my personal help with your trading

If you're tired of going it alone and you'd like my help with your trading, especially consistency, book a call with me by clicking here

Risk Disclosure

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Affiliate Disclosure

The sender of this message may have an affiliate relationship with the organizations referenced in the message. Using these links is effectively the same as going directly to the referenced site, but special links are used to track opens and activity. Clicking the links on this page and making a purchase may create an affiliate commission for the sender at no cost to you.

HYPOTHETICAL PERFORMANCE DISCLOSURE:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses is material points, which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect trading results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

![Read more about the article [Day Trading Psychology] “What I Need To Fix Is ME!”](https://insideouttrading.com/wp-content/uploads/2022/12/fix-me-300x158.png)