Do you ever feel like this with your trading?

That when it comes to trading strategies, you just can't find seem to find one that let's you actually relax and feel secure in what you're doing?

It's like being in a rowboat in the ocean and you're thirsty as heck, and you don't have any fresh water

The old adage: “Water, water everywhere and not a drop to drink”

And you've been thirsty for a while now

It seems like you go looking for a good strategy for yourself, and every Tom, Dick and Harry has a clever one for sale for $5,000+

…but none of them seem to work, at least not for long

The thing is, there ARE good strategies freely available to you

Lots of them

Strategies that work, that have been proven out over years, some over decades

So it may feel and appear like what you're missing is a good strategy

… but the truth of the matter is that it's not really a strategy you're looking for

What you're really looking for is the ability to take any of the dozens of freely available strategies (or create your own) and to go to the markets with the confidence and consistency knowing you're solid with it

That comes from something other than the strategy itself

To find out what that something is, click here

This is the same methodology that is responsible for billions in profits around the world, and you can put it to use in your trading for amazing results

Check it out

Cheers

Brian McAboy

“The Consistency Coach”

Host of the “Consistent Profits Podcast“

“Focus on consistency first, because when you have consistency, profit is easy”

P.S. Whenever you're ready, here are 3 ways I can help you make more money and more consistently with your trading

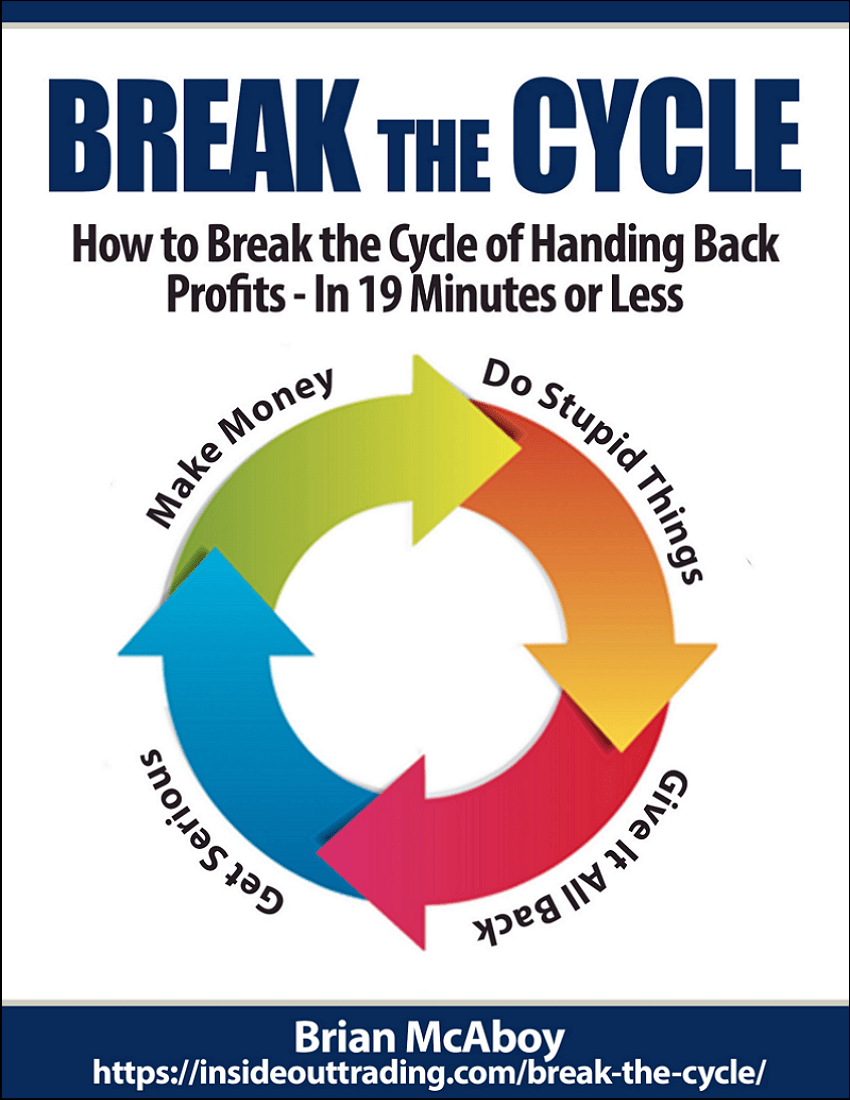

1. Are you ready to break the cycle of ‘make money, give it back'?

Discover the things you can do in the next 19 minutes to break the cycle.

That's right, just 19 minutes, including the time it takes to read the very short guide

Get the pdf here -> Break the Cycle

2. Check out the “The Science of Consistency Applied to Trading”

This is the recording of a masterclass I did a while back that shows you how to take advantage of the success secret being used in other industries – and how you can use it in your trading to maximize profits and peace of mind – click here

3. Get my personal help with your trading

If you're tired of going it alone and you'd like my help with your trading, especially consistency, book a call with me by clicking here

Risk Disclosure

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Affiliate Disclosure

The sender of this message may have an affiliate relationship with the organizations referenced in the message. Using these links is effectively the same as going directly to the referenced site, but special links are used to track opens and activity. Clicking the links on this page and making a purchase may create an affiliate commission for the sender at no cost to you.

HYPOTHETICAL PERFORMANCE DISCLOSURE:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses is material points, which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect trading results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

![You are currently viewing [Trading] Strategies, Strategies Everywhere and Not a One To Use](https://insideouttrading.com/wp-content/uploads/2023/10/water-water.png)

![Read more about the article [Day Trading Psychology] “What I Need To Fix Is ME!”](https://insideouttrading.com/wp-content/uploads/2022/12/fix-me-300x158.png)